|

|

|

Amazon has been heavily expanding into areas that the government

designates for special tax incentives, according to a new analysis that

comes amid growing regulatory scrutiny of the e-commerce giant.

The company has put delivery stations, fulfillment centers, and even an

air hub in "opportunity zones," regions across the country where

investors can qualify for capital gains tax breaks. The initiative was

intended to incentivize investment in some of the most economically

distressed regions of the country.

But critics have raised concerns that such programs further enrich

wealthy investors and corporations for projects that would have happened

without government assistance. Read more

|

Beanie Babies mogul Ty Warner, owner of Santa Barbara’s iconic Four

Seasons Resort The Biltmore, has appealed the assessment of the luxury

hotel’s property value.

In 2020, agents for the reclusive owner said the Biltmore was worth

$52.9 million, while county assessors said it was worth $232.1 million.

The following year, agents for the hotel’s ownership group insisted the

property was worth $117.1 million, while the county assessor valued it

at $234.3 million. Read more

|

|

|

|

|

|

IAAO NEWS

|

|

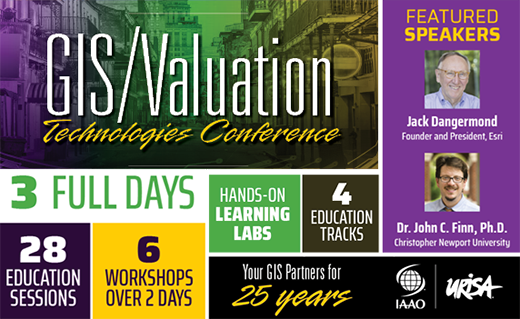

GIS/Val Tech Conference hotel deadline is Feb. 22

Tuesday, Feb. 22, is the deadline to reserve a room in the hotel block

for the 25th Annual GIS/Valuation Technologies Conference, which is

March 27-30.

The conference will take place at the Hilton New Orleans Riverside

hotel in New Orleans. Jack Dangermond, founder and president of Esri, an

international supplier of GIS software, will be the opening keynote

speaker. Other keynotes include a presentation by John C. Finn, Ph.D.,

of Christopher Newport University, on "Geography of Segregation in the

21st Century," and a presentation by Water Wise Gulf South on ways to

advance green infrastructure.

Nominations accepted for IAAO Awards, Fellows

IAAO is accepting nominations for its Awards Program and Fellows

Program through May 1. The Awards Program boasts 17 categories

recognizing individual and organizational achievements in several areas,

including publications, technical expertise, and service to IAAO. Award winners and Fellow selections are recognized at the IAAO Annual Conference.

The Awards Program is a highly visible event and all IAAO members and

affiliated organizations are encouraged to submit nominations. Fellow

nominees are brought forth by the IAAO membership each year and

submitted during the awards nominations period. Read more on the Fellows program, and also all IAAO awards

IPTI, IAAO to co-present symposium on Mass Appraisal Valuation; topics sought by Feb. 28

IAAO

and the International Property Tax Institute will be working together

to host an online symposium on mass appraisal valuation, “Applications

and Challenges,” on June 22-23, and are seeking presenters to be

included in the program.

The submission deadline is Feb. 28 and appraisal, valuation and

assessment practitioners, valuation/assessment agency managers,

municipal representatives, policymakers, technology professionals,

academics, and educators interested in sharing experiences and knowledge

relative to property tax policy and valuations, including innovations,

theory, application, management, and practices should apply. Symposium

registration will open in the spring. Read more

Professional Development Standard comments

due by March 4

IAAO’s Board of Directors recently approved a revised version of

"Standard on Professional Development" for 30-day exposure to the

membership.

The revised draft standard covers basic guidelines for the professional

development, education, and certification of assessing officers,

including appraisers, assessment managers, tax policy administrators,

mappers, and assessors; those who provide professional or technical

assistance to assessing officers; those who supervise or review the work

of assessing officers; and those who seek employment in assessment

administration.

Comments on the proposed standard should be sent no later than March 4 to Larry Clark (clark@iaao.org), IAAO Staff Liaison to the Research and Standards Committee. Read more

Annual Conference registration opens in April

Registration for the 2022 IAAO Annual Conference will open in April.

IAAO’s Annual Conference is set for Aug. 28-31 at the Sheraton Boston

and Hynes Convention Center.

IAAO Annual Conferences are the industry’s premiere event to learn best

practices, emerging technology, trends, and to connect with others in

the field. The 88th annual conference will offer a variety of education

session presentation choices, roundtable talks, and panel discussions

presented over the three days.

The conference headquarters hotel in downtown Boston is in the historic

Back Bay neighborhood and directly connected to the Hynes Convention

Center. The hotel is within easy walking distance of many of the city's

famous sights, including the iconic Fenway Park and the Museum of Fine

Arts.

The early-bird registration fee is $730 for members and $925 for

nonmembers and will be available through Friday, July 15. Go to the conference page on the IAAO website for more details.

2022 in-person IEW set for June in Kansas City

Applications

are being accepting for anyone interested in becoming an IAAO

instructor. The IAAO Professional Development Department, along with the

IAAO Education Committee, is offering the Instructor Evaluation

Workshop including auditions June 16-18 at the IAAO headquarters in

Kansas City.

Accommodations will be a short walk to the headquarters building. Those

who pass the audition will be considered a junior instructor and will

be able to teach in the live classroom. Bilingual applicants are

encouraged to apply. Spots are limited, so apply now by clicking this link . Registration ends April 8.

IAAO building donation campaign underway

With every donation greater than $500 by a single

individual, chapter or affiliate, jurisdiction, or company, the donor

will be permanently commemorated at IAAO Headquarters with their name on

a star, and receive a commemorative gift for their home or office.

★ Donations of $500-$999 receive a small star.

★ Donations of $1,000-2,499 receive a medium star.

★ Donations equal or greater than $2,500 receive a large star.

Donations will help fund an updated and modernized

meeting room with the technology needed to function in today’s global

climate; and alignment with the newly approved Strategic Plan, which

shifts resources for the Headquarters Team into functioning units

including team “pods” and additional offices in spaces previously used

for shipping and storage.

IAAO is a 501(c)(3) non-profit organization so your donation is tax deductible to the extent allowed by the IRS.

IAAO accepting applications for assessor position

IAAO is accepting applications for the newly created position of assessor.

Focused on providing analysis of jurisdictions based on IAAO standards

and best practices, IAAO seeks an initiative-taking,

member/customer-centric leader who has a strong background on all things

assessment administration and mass appraisal.

The ideal candidate is a visionary with the ability to execute

actionable plans that positively impact individuals and the industry.

Innovative and creative, the ideal candidate should also possess

high-level communication skills, along with demonstrable analytical and

technical abilities, especially in assessment administration and mass

appraisal. The assessor is part of the Business Innovation Team,

reporting directly to the Senior Director, Business Innovation.

This salaried, exempt position works within IAAO’s Business Innovation

pillar in our Association’s newly approved strategic plan. Read more

|

| AROUND THE INDUSTRY

|

Town challenges status of congressional candidate’s house as a tax-free parsonage

A Morris County, New

Jersey, town is challenging the tax-free status of congressional

candidate Phil Rizzo’s house, which is classified as a parsonage. Rizzo

sold his luxurious Harding Township house in 2017 to his small City

Baptist Church in Hudson County, of which he was president and sole

pastor.

But Rizzo, who is

running for U.S. Congress, announced that he was taking a leave of

absence as pastor. His church, which operated out of a small storefront,

has since closed. The five-bedroom, seven-bath house is on six secluded

acres. Read more

Rescue Plan funding tracker distinguishes city, county budgeting priorities

It’s been almost a year

since President Joe Biden signed the American Rescue Plan into law. At

the time, the pandemic was forcing local governments to slash budgets to

keep up with rapidly evolving crises — from struggling businesses to

vaccination drives — and communities faced an uncertain future.

The $1.9 trillion

stimulus package, known as “ARPA,” set aside $350 billion exclusively

for local governments. It featured spending flexibility that lent

support to response measures and gave administrators an opportunity to

look beyond the pandemic. Read more

What property tax changes are being considered

in Germany?

With the change of

leadership in Germany late last year, several changes to the ways

properties are taxed are on the table, according to Roland Bomhard, a

partner at the law firm Hogan Lovells International, who is based in

Düsseldorf. These initiatives were outlined in the new government’s

coalition agreement in January, and are expected to be rolled out over

the next four years. Read more

Missouri bill would end reporting of property sales to counties, require permission for assessor inspections

Rep. Bill Kidd, a Kansas

City-area Republican, admitted his bill regulating county assessors and

recorders of deeds needs refining, but its intentions remain constant.

“I stirred up a little wasps nest here with some unintended

consequences,” Kidd told the House Local Government Committee during a

hearing on his bill.

House Bill 2419

eliminates any requirement to provide a county recorder of deeds with

the sale price for a deed, mortgage, conveyance, deed of trust,

assignment, bond, covenant or defeasance. Read more

Report: Colorado property tax rates poised

to skyrocket in coming years

Coloradans are facing

massive property tax increases in the coming years due to a combination

of the state's surging real estate market, the tax system's biennial

assessment calendar, and the looming expiration of measures adopted to

ease the shock of tax hikes, according to a study released last week by

business coalition Colorado Concern. Read more

|

|

|

+ Phoenix

Business Analytics/CAMA Supervisor, Maricopa County See moreChief Appraiser, Maricopa County See more

+ Needham, Massachusetts

Director of Assessing, Town of Needham See more

+ Fairfax, Virginia

Financial and Program Auditor (Management Analyst IV), Fairfax County Government See more

+ Charlottesville, Virginia

Assistant Assessor, Albemarle County See more

+ Conroe, Texas

Director of Commercial Operations, Montgomery Central Appraisal District See more

+ Fayetteville, North Carolina

Real Estate Appraisal Supervisor, Cumberland County Tax Administration See more

+ Fort Collins, Colorado

Appraiser I, Larimer County Assessor See more

+ Kissimmee, Florida

Commercial Appraiser, Osceola County Property Appraiser See more

+ Fort Wayne, Indiana

Senior Data Analyst, Allen County Assessor's Office See more

+ TBD, Ontario, Canada

Manager, Centralized Properties, Municipal Property Assessment Corporation See more

+ Fort Pierce, Florida

Commercial Real Estate Appraiser, Saint Lucie County Property Appraiser's Office See more

|

|

|

|

|

|

International Association

of Assessing Officers

314 West 10th Street

Kansas City, Missouri 64105

816-701-8100

|

|

|

Share news:

Keith Robison

|

|

|

|